Insurance plan for younger Grownups is usually a thing that’s not entirely understood, mainly mainly because it’s not a thing you consider after you’re just beginning to stand all by yourself. But listed here’s the point: daily life can transform fast, and a person moment you’re in addition to your match, and the subsequent moment, you may be addressing an unanticipated price, damage, or worse. So, what precisely does "insurance policy for younger Older people" imply, and why can it be so vital that you have necessary protection choices in place? Permit’s break it down.

Initially, insurance is one of those items everyone knows we'd like, but we don’t often want to cope with. It really is like flossing – we realize it’s good for us, but it’s easy to skip. Nevertheless, skipping insurance coverage for youthful Older people may have significant implications. The fact is, coverage assists protect you within the fiscal chance that comes with daily life. Whether it’s health issues, motor vehicle accidents, or even harm to your property, acquiring protection set up offers you a safety Web to slide back on.

Indicators on Insurance For Young Adults Essential Coverage Options Explained You Need To Know

Whenever we take a look at insurance policies for youthful adults, we’re not only talking about a single sort of protection. There are several essential kinds of insurance policies that each younger adult need to think about. Permit’s get started with health insurance policy. We’re normally in the prime of our lives at this age, considering we’re invincible. But right here’s the matter: accidents and health problems don’t treatment regarding how younger or healthy you feel. With out health insurance, a simple excursion into the crisis area can Charge Many pounds. That’s a chance you don’t wish to acquire.

Whenever we take a look at insurance policies for youthful adults, we’re not only talking about a single sort of protection. There are several essential kinds of insurance policies that each younger adult need to think about. Permit’s get started with health insurance policy. We’re normally in the prime of our lives at this age, considering we’re invincible. But right here’s the matter: accidents and health problems don’t treatment regarding how younger or healthy you feel. With out health insurance, a simple excursion into the crisis area can Charge Many pounds. That’s a chance you don’t wish to acquire.A different important insurance form for youthful adults is vehicle insurance policy. For those who generate a car, this is completely non-negotiable. Not only can it be essential by legislation in many sites, but it surely’s also there to protect you economically in the event you get into an accident. Even if you’re a very careful driver, mishaps can materialize to any individual, and without the need of insurance, you’re about the hook for repairs, medical payments, and in many cases legal expenses if someone else is included. Consider it using this method: car insurance policy is like sporting a helmet when Driving a bike. Chances are you'll hardly ever need to have it, but if you need to do, you’ll be happy you might have it.

But wellbeing and vehicle insurance plan aren’t the only real options on the market. How about renters’ coverage? In case you’re leasing a spot, renters’ insurance policy is a kind of things which doesn’t feel significant till a little something goes wrong. Envision your condominium receives flooded or your stuff is stolen – how would you exchange your possessions? Renters’ insurance policy handles the cost of misplaced or broken objects, and it’s generally way more reasonably priced than you’d Imagine. As well as, it usually involves legal responsibility coverage in case another person will get injured on the house.

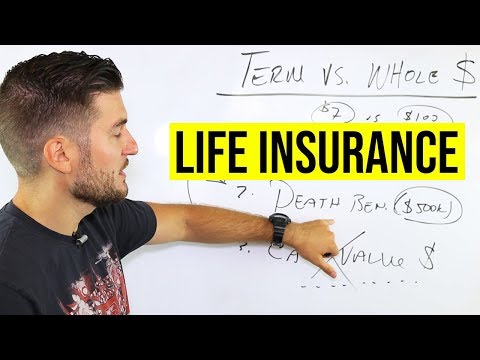

In regards to insurance policy for younger adults, Just about the most ignored forms is existence insurance coverage. Now, you may be wondering, “I’m way too young for life insurance coverage,” but here’s the offer: getting lifetime coverage any time you’re younger is actually one of the smartest monetary moves you may make. Why? As the younger and healthier you are, the more affordable your premiums will likely be. Existence insurance policy is made to assist include your family and friends fiscally if one thing transpires to you personally, but it’s also a terrific way to lock inside of a low fee that would previous for decades.

In the event you’re self-used or planning to commence your own private small business, you’ll will need another form of insurance coverage known as business enterprise coverage. This helps protect you and your company in case of unexpected activities. From liability promises to home destruction, small business insurance plan guarantees you don’t go bankrupt as a result of issues outside the house your Command. Even when you’re a freelancer, this can be a lifesaver. It’s like creating a cushion for your small business which means you’re not ignored while in the chilly if factors go Erroneous.

Now, Allow’s mention disability insurance coverage, which is an additional crucial protection option for youthful Older people. It’s not the most enjoyable subject matter, but it really’s incredibly significant. Incapacity insurance policy offers profits substitution If you're able to’t function because of an damage or health issues. Consider this: what if you broke your leg and couldn’t go to work for months? With no incapacity insurance plan, you’d should rely on discounts or obtain another way to assist yourself. For lots of younger Older people, that’s a large challenge, and that’s why disability insurance policies is really worth thinking about.

And How about umbrella insurance coverage? This is something not lots of younger adults think of, but it may be a recreation-changer. Umbrella insurance policies acts as additional liability protection that kicks in when the limits within your other insurance policy policies are arrived at. So, Permit’s say you enter into a car accident as well as damages exceed the boundaries of your car insurance – umbrella insurance coverage allows go over the difference. It’s like having a backup insurance plan for your personal backup policies. Slightly further safety hardly ever damage everyone, suitable?

Now which you recognize many of the essential insurance plan protection choices for younger adults, Permit’s speak about why it is advisable to get started considering most of these insurance as early as you can. The primary rationale is money stability. Not one person likes the idea of paying for insurance, but look at this: would you fairly spend a small monthly high quality for insurance now, or hazard dealing with substantial health care charges, a totaled vehicle, or lost belongings in a while? Insurance is usually a means of purchasing your economic long run, even when it doesn’t often come to feel like it.